https://www.pexels.com/photo/person-writing-on-white-paper-8927687

Tax debt can be overwhelming, creating a ripple effect on every aspect of your life. For many, the weight of unpaid taxes isn’t just about finances; it’s also an emotional and psychological strain. The fear of penalties, garnished wages, or even legal consequences can feel insurmountable. Understanding your options when tax debt becomes unmanageable is the first step toward regaining control. One such option includes exploring what is considered a financial hardship, as this could determine eligibility for specific relief programs.

The Reality of Tax Debt

The first thing that any indebted taxpayer needs to do is to face the reality of unmanageable tax debt. If the taxpayer disregards the IRS notices or procrastinates on taking some specific step, the penalties and the interest keep adding, which is unhelpful for an already struggling financial situation.

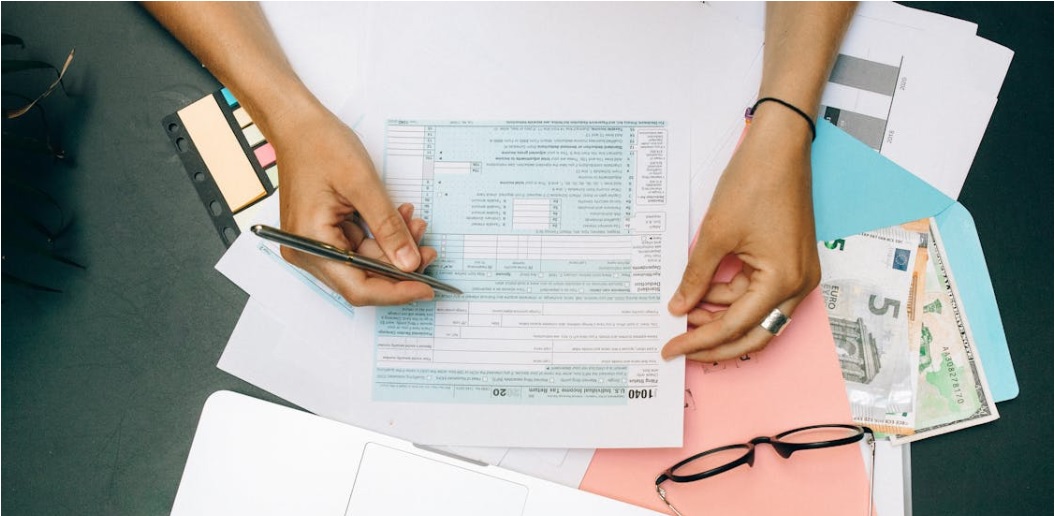

Be sure, however, to take the time to review your financial situation with complete candor. You should compile all the documents, including tax returns, other notices from the IRS, and financial statements, to understand the amount you owe. This process may seem quite challenging, but one needs to see the big picture of the situation.

After evaluating your position, it may be wise to consult a professional. Advice can be given according to individual circumstances which can be given by tax consultants or attorneys. They are in a position to bargain for you, perhaps finding a way to lower the total debt or establish a way of paying it. They can also explain to you your choices, such as a payment plan, the chance to settle the debt for less through an Offer in Compromise, or special programs meant for those who owe a lot in taxes.

Exploring Relief Options

The best solution for handling high unmanageable tax debts is to look for relief options provided by the IRS. These programs are created to support taxpayers who cannot pay the money they owe. For instance, negotiate for the payment of the debt in installments where you will make small periodic payments towards the debt. If you are in a bad financial situation, you can apply for a program that the IRS has known as the Hardship Program, which only puts the collection on hold while you struggle to find a way forward.

The IRS Hardship Program is most useful for people with major problems of this kind. If you qualify for this status, the IRS can claim that your account cannot be collected, which will halt things such as wage garnishments or bank levies. Although it doesn’t pay off the debt, it provides some time to get your financial situation under control. It is important to know the qualifications of this option – income and asset restrictions – to qualify for the program and receive maximum benefits from it.

Staying Ahead of Future Tax Obligations

After you have acted to deal with the existing tax issues, it is crucial to start working towards leading a financially healthy life. This involves developing an operational budget that will factor in future taxes so that you do not remain in the same position again. Setting up a tax expense as a regular monthly or weekly expense might not be a bad idea if you are self-employed or earn income that does not have taxes automatically deducted. Filing taxes also plays an important role in avoiding unnecessary penalties, which are also a result of disorganization.

Further, services such as tax advising or reading materials explaining the specific tax exemptions, credits, and other options to save on taxes should be used. Having a much better relationship with your money not only helps to cut down stress but also helps you to take charge of taxes.

Conclusion

When taxes become unmanageable, they seem insurmountable; however, help is available to escape this situation. Taking the reality of your debt, looking for options such as the IRS Hardship Program, and planning your further financial strategy are all vital stages. Staving off this problem may not be easy, but addressing your tax problem head-on is much wiser and will help you gain closure and move forward. Taking action now will help secure your financial future and let you move beyond having to deal with overwhelming taxes.